008613968780263

008613968780263 Industry News: DC Button Switch - Technological Innovation and Market

Growth Advance Hand in Hand In recent years, driven by the rapid development of the new energy, industrial automation, and consumer electronics sectors, DC Button Switches (direct current button switches), as key control components, have witnessed a steady surge in market demand. According to 2025 industry data, the global DC Button Switch market size is expected to exceed 1.72 billion US dollars*and grow at a compound annual growth rate (CAGR) of 6.6%to reach the target of 3.26 billion US dollars by 2035. This growth momentum is mainly fueled by the popularization of renewable energy systems, electric vehicle (EV) charging infrastructure, and smart homes.

Technological Innovation Drives Performance Upgrades

- Intelligent and Integrated Trends

Manufacturers are accelerating the integration of DC Button Switches with IoT (Internet of Things) technology, launching smart switches that support remote control and status monitoring. For instance, SCHURTER's DG11 power input module has added a magnetic release function, which can quickly cut off the circuit in case of a short circuit, while integrating a Ta 35 circuit breaker to achieve overcurrent protection. Such products are widely used in industrial equipment and data centers, enhancing system reliability and operation efficiency.

- Breakthroughs in Materials and Processes

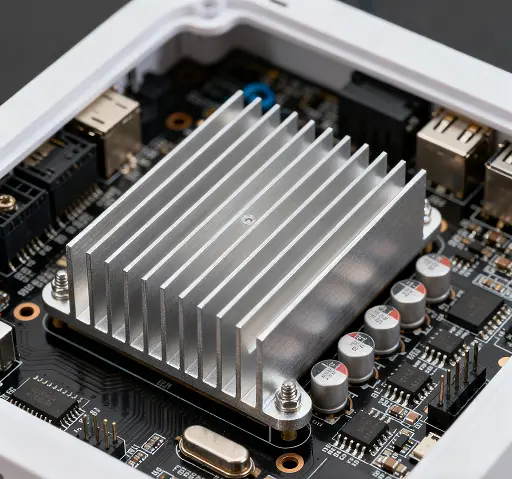

Metal button switches have achieved high-brightness and low-power design through optimized LED backlight solutions. Dual-color backlights (e.g., red/green status indicators) and RGB dynamic lighting control have become mainstream. Particularly in automotive central controls and smart home control panels, PWM (Pulse Width Modulation) dimming technology has reduced energy consumption by more than 30%. Additionally, MEMS (Micro-Electro-Mechanical Systems) switches, with their miniaturization (size < 1mm) and high-frequency response characteristics, are emerging in 5G communication equipment.

- Improvements in Environmental Protection and Reliability

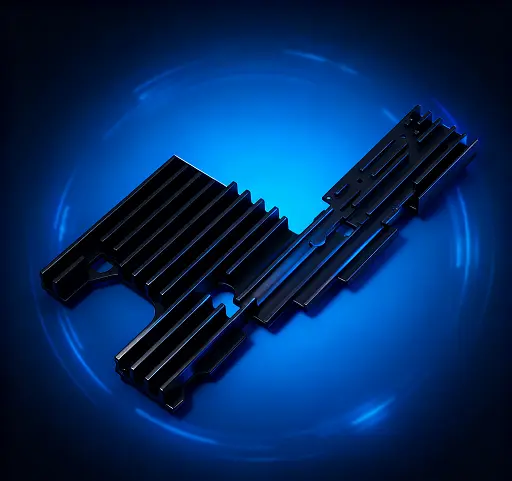

Industry standards are becoming increasingly stringent. The 2025 Quality Sampling Inspection Rules for Changeover Switchgear implemented in Yueqing City require products to meet IP67 waterproof rating and UL certification. Manufacturers use corrosion-resistant materials (such as stainless steel housings) and gold-plated contacts, increasing the switch lifespan from 100,000 operations to over 500,000 operations, which meets the strict requirements of outdoor photovoltaic inverters and marine equipment.

Diversified Expansion of Application Fields

- New Energy and Energy Storage Systems

DC Button Switches are indispensable in solar inverters and battery management systems. For example, photovoltaic power plants need isolation switches to achieve safe power-off during component maintenance, while energy storage equipment relies on high-voltage (1500V) switches for charge-discharge control. The global photovoltaic installed capacity is expected to exceed 300GW in 2025, directly driving a 20% growth in demand for related switches.

- Electric Vehicles and Charging Networks

On-board DC-DC converters and charging pile control modules have higher requirements for switches' high-voltage resistance (above 750V) and anti-vibration performance. After being acquired by Littelfuse, Carling Technologies launched high-reliability switches suitable for electric vehicles, whose market share in the emergency cut-off function of charging guns has reached 15%. Furthermore, the number of new energy vehicles in China has exceeded 50 million, driving a 25% annual growth in demand for charging pile switches.

- Industrial Automation and Consumer Electronics

In the field of industrial machinery control, DC Button Switches support multi-channel signal transmission through modular design. For example, Schneider Electric's XB2 series products can integrate multiple functions such as emergency stop and reset. In the consumer electronics sector, tactile switches, with their miniaturization (24mm panel mounting) and long lifespan (over 100,000 operations), are widely used in power control of smartphones and smart speakers.

Market Competition and Regional Pattern

- Market Dominance by Leading Manufacturers

The global DC Button Switch market is highly concentrated, with enterprises such as ABB, Siemens, and Schneider Electric accounting for nearly 50% of the market share. Chinese manufacturers, such as Wenzhou Jinhong Electric, have entered the international supply chain through the ODM (Original Design Manufacturing) model and hold a 20% share in the mid-to-low-end market, but high-end products still rely on imports.

- Significant Differentiation in Regional Markets

North America and Europe, with high levels of industrial automation, dominate the high-end market, and their product average prices are 30% higher than those in the Asia-Pacific region. As the world's largest production base, China's straight key switch output reached 1.2 billion units in 2024, and it has exported production capacity to Southeast Asia and the Middle East through the "Belt and Road" Initiative.

Challenges and Future Outlook

- Supply Chain and Cost Pressures

Fluctuations in the prices of raw materials such as metals (copper, stainless steel) and plastics directly affect profits. The 15% increase in copper prices in 2024 led to a 5-8 percentage point drop in gross profit margins for some manufacturers. Enterprises are alleviating pressures through futures hedging and localized procurement.

- Policy and Compliance Requirements

China's 2025 equipment renewal policy has included DC Button Switches in the industrial automation subsidy scope, driving demand for the replacement of old and outdated equipment. Meanwhile, the EU RoHS 3.0 Directive requires the elimination of lead-containing contacts by 2026, forcing manufacturers to adopt lead-free soldering processes.

- Opportunities in Emerging Markets

The manufacturing upgrading in Southeast Asia and India has created incremental space for DC Button Switches. For example, India's "Make in India" program has driven a 40% growth in local photovoltaic inverter production, leading to a surge in import demand for related switches.

Conclusion The DC Button Switch industry is in a critical period of technological iteration and market expansion. Manufacturers need to focus on the directions of intelligence and green development while addressing supply chain risks and regional trade barriers. With the deepening of the new energy revolution and Industry 4.0, this niche market is expected to continue leading the electronic component sector in the next decade, becoming a core link connecting traditional industry and the digital economy.